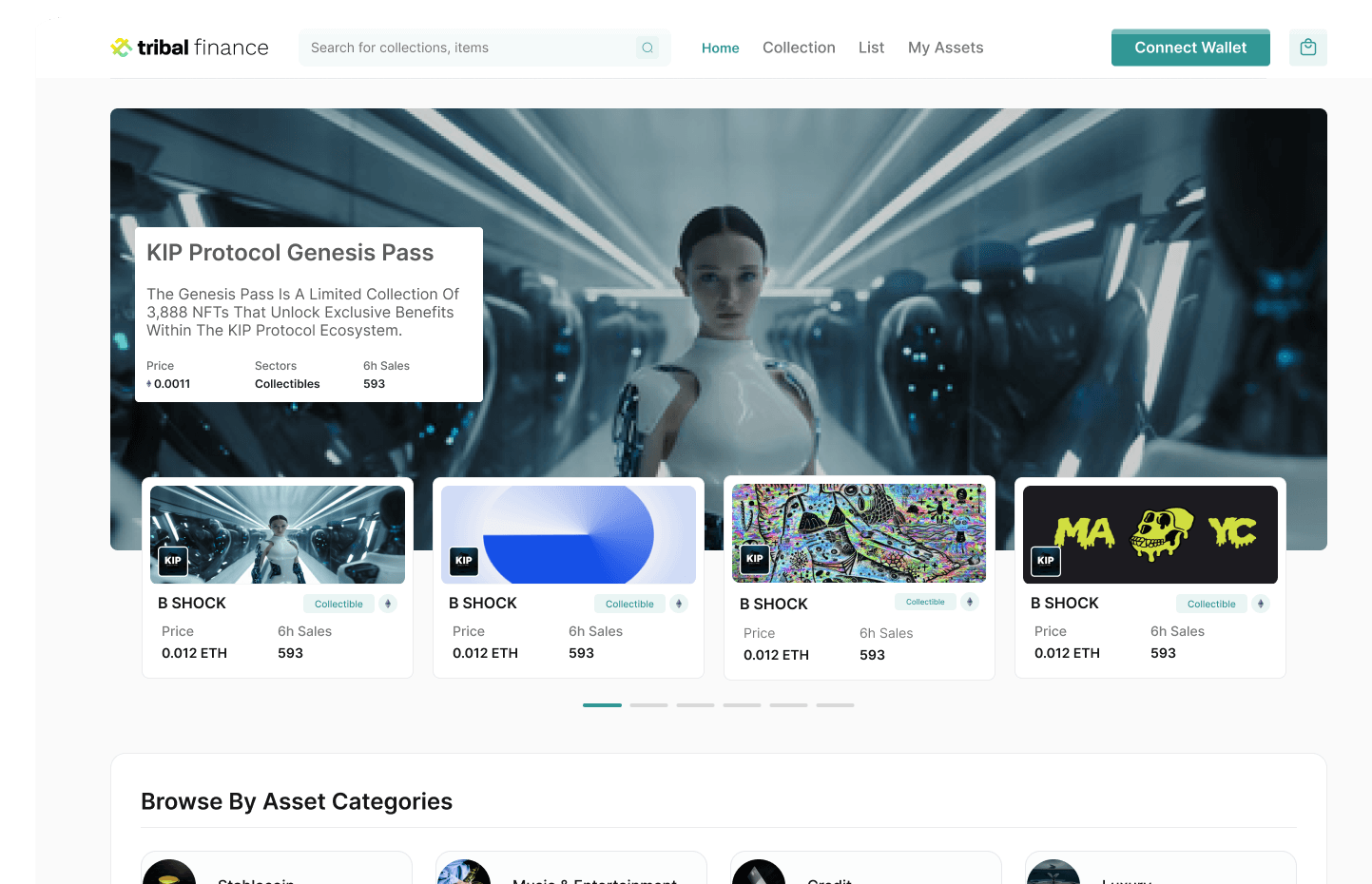

Tribal Finance is an All-in-One RWA Platform

Tribal combines an asset tokenization platform, aggregated RWA marketplace, and asset originator into one RWA protocol.

Join over 31,000 subscribers! Be the first to know about Tribal Finance news

Trusted by top investors around the world